If there’s one certainty that’s going to puncture the Trump burn-baby-burn euphoria, it’s money. Big money. Yuge, even. Let’s call it raw capitalism laced with irony.

In today’s global energy market, the renewables story is weighed in billions of dollars, and the more the zeros stack up the louder the noise and the more it drowns out the naysayers and ideologues (on both sides).

Renewable energy is becoming a global financial behemoth that costs less to build, less to run and generates more profit more quickly than fossil fuels. And the speed of the roll-out and technical innovation is running years ahead of expectations.

So yes, a lot of people and companies really are getting rich. It’s heady stuff, even in oil-soaked Texas (which now has more renewable energy than California). If Trump opts the US out of this revolution, he will shackle his fanbase to high energy costs and dying global markets for oil, gas, ICE vehicles and more.

Take a look at the NYSE and it’s clear that renewable stocks are the new Wild West for investors. It’s a hot and volatile market with big winners and losers, and plenty of brash start-ups scrambling for a slice of the action. So I’ve been wondering, what’s in it for you & me? How can we save the world and turn a buck?

Even the oil majors are grabbing a slice of the renewable action. ‘Diversifying’, they mumble, which is a coy way of admitting they’re betting against themselves. And if you have the words ‘stranding asset’ stamped on your forehead, that’s a good idea. Also spare a thought for the 2/3 of the global shipping fleet that carries fossil fuels (it’s, er, tanking).

Popular wisdom says we’ll always need fossil fuels to deliver power when the sun don’t shine, the wind don’t blow and the grid gets cranky. Allegedly, fossil fuels will save the day and deliver this essential baseload energy.

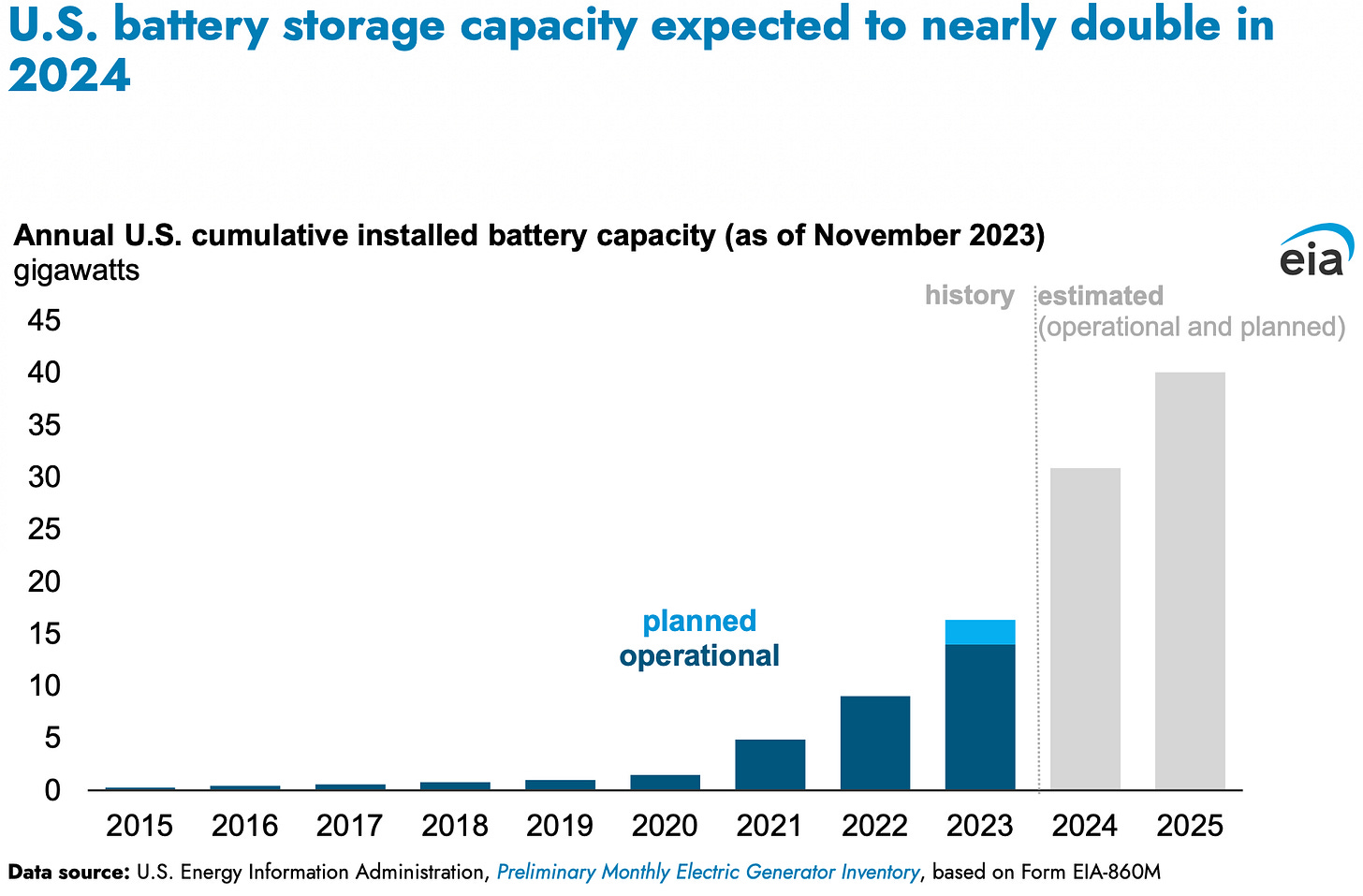

Well, that’s baloney: Battery capacities are soaring as prices tumble. Household, urban & industrial batteries made with cheap-as-chips sodium are about to transform world energy supplies. It’s one of the most common, affordable and accessible elements on Earth.

A huge new market is emerging for everything from my home to your city. And there are fortunes to be made. Green, of course. Because sodium batteries store and then deliver low-cost wind and solar electricity where and when you want it 24/7, making peak demand and grid bottle-necks dim memories.

So here’s my New Year’s challenge for you: Can you pick the companies that will dominate sodium battery production in what the Economist Magazine calls the next trillion-dollar industry? And if you know something even cheaper than sodium, that counts too.

Consider this: If you’d put $1,000 into Apple stock when Steve Jobs returned in February 1997 and held on until now, you’d have $1.8 million.

So while Trump daddy-dances head-on into the green $ tsunami, how can the rest of us get a more constructive slice of the action? Where should we invest our piggy bank contents?

This is harder than it should be because the world-leading sodium battery companies are Chinese and they have a very big R&D and production head start. Closer to home, it’s a chaotic field of jostling newbies & big buck players. Northvolt has recently folded and China’s CATL is opening a joint venture in Spain. It’s all very competitive, the stakes are high and there will be big winners and some spectacular bellyflops.

So, if you were going to give yourself (or your kids) $100 of stock in a non-Chinese battery company, which would you pick? And would you really give it to the kids, or is it too valuable to hand over? I mean, after all, it’s your money, you’ve worked hard for it, they can wait …

And a Happy and Prosperous New Year to one and all.

From fishing to share tipping: what variety! Happy New Year.

Bravo - another brilliant challenge to start the New Year!